FHA mortgage conditions to own personal financial insurance policies

One of the biggest traps to buying a home for many first-date people is coming with the brand new deposit. The fresh Federal Casing Management (FHA) is actually centered for the 1934 to help resolve one problem.

https://paydayloancolorado.net/atwood/The FHA means mortgages supplied by partner finance companies to really make it easier for first-big date homebuyers to acquire a house. Homeowners can also be set out a lot less towards home than simply it do which have a traditional financial, while the FHA mortgage insurance protects lenders if your resident non-payments on the mortgage. It’s less risk towards the financial and less barrier-to-entry to possess first-go out people.

Due to the fact the founding, the fresh FHA possess insured more than 46 billion mortgage loans. While the FHA financing produces homeownership simple, they continues to have the its own conditions for down costs, fico scores, debt-to-earnings ratio, personal home loan insurance rates, and you can monitors. Let’s dig inside the.

Whatever the type of home loan you choose, credit ratings are a big factor in your own eligibility. The same goes to own an FHA mortgage.

Your credit score commonly find the expense of the advance payment. Having traditional mortgage loans, the financial institution usually need an excellent 620 FICO score which have 20 percent deposit a lot higher than the FHA financing needs.

An enthusiastic FHA mortgage enjoys a minimum credit rating of 500. In the event your credit rating is actually ranging from five hundred and you may 579, the new FHA requires a 10 percent deposit. If the credit rating try 580 or maybe more, you merely come up with 3.5 percent off. Put simply, that is just $3,500 for each and every $100,000 borrowed.

FHA loan conditions to possess obligations-to-money ratio

Your debt-to-earnings (DTI) ratio ‘s the part of your own month-to-month revenues used to pay for month-to-month expenditures. Loan providers see two DTI rates: total loans and you may home loan debt. Lenders use restrict rates to make certain consumers have enough monthly income to expend most of the costs particularly the home loan.

A keen FHA mortgage is more big than simply more lenders in terms of the most DTI. The fresh new FHA kits brand new maximum on . The initial amount means your total monthly loans. This means that when you make sense all of your current month-to-month expenses home loan, car payment, handmade cards, college loans it can’t meet or exceed 43% of one’s monthly money. Another count is the restriction count the borrowed funds should be of one’s month-to-month money not more than 30 %.

Such as, if one makes $5,000 per month, you can’t do have more than simply $2,150 supposed towards loans monthly. The maximum mortgage payment limits at $step 1,550 four weeks.

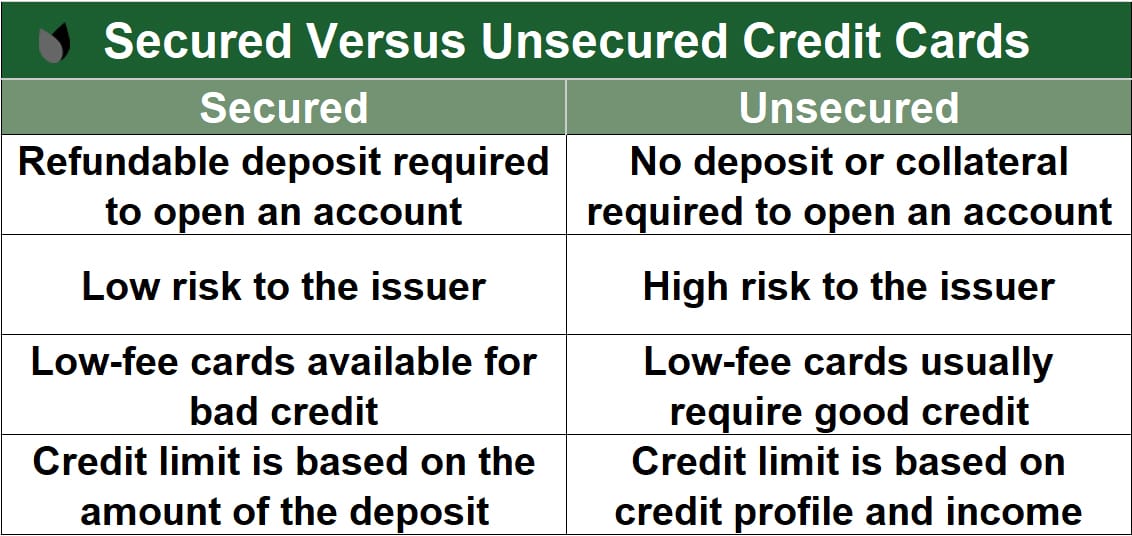

Private home loan insurance, otherwise PMI, is a type of insurance rates one handles loan providers if the a property owners defaults towards the loan. It is expected once you put lower than 20 percent upon a home. Try not to confuse it that have homeowners insurance, which handles the house against bodily destroy.

Having an FHA mortgage, homeowners have to has actually financial insurance policies and you may spend what is titled initial home loan top (UFMIP). Brand new initial number is actually step 1.75 per cent of one’s amount borrowed paid down within closing. It can also be rolled into the mortgage.

The latest monthly home loan cost (MIP) is between 0.45 and you may step one.05 percent of your own amount borrowed. The variation depends on the loan down payment and you may name. You pay the MIP into life of the new FHA mortgage for many who set-out below 10 percent. For many who establish ten percent or even more, you have to pay financial insurance premiums getting eleven decades.

FHA loan requirements for domestic just like the top home

An enthusiastic FHA loan was created to let individuals getting homeowners, not traders. For this reason the brand new FHA requires that the home ought to be the buyer’s no. 1 residence. To phrase it differently, you must inhabit the house you’re to invest in which have a keen FHA financing.

FHA financing criteria getting monitors and you may appraisals

Brand new family orders that have an enthusiastic FHA loan need to see minimum assets criteria established of the Agencies off Casing and you can Metropolitan Invention (HUD). This new review statement must prove the house is safe, voice, and you will safer.

Many homebuyers use the assessment report to negotiate getting repairs or loans, new FHA looks at the are accountable to ensure that the household matches lowest HUD requirements.

- Structurally sound foundation.

- Water drainage out of the house.

- Performing resources.

- Doing work products.

- Sizzling hot and cold water having sufficient water stress.

- No chipping otherwise cracking decorate.

- Safely functioning electrical channels and you may changes.

- Screen that may open, close, and lock.

- Zero roof leakages and you may a threshold with no less than couple of years lifestyle leftover.

An FHA mortgage is going to be declined in case the property cannot meet this type of criteria. Brand new inspection and also the assessment can happen on different occuring times. Because the assessment discusses the function away from things for the and you will around the home, the new assessment considers market price in contrast to most other belongings throughout the area.

The new assessment need certainly to meet or exceed the level of the borrowed funds. In the event your assessment will come in within the mortgage well worth, the mortgage commonly often not recognized or you will features to build dollars to make upwards on the variation.

Final note on the FHA loan conditions

The latest FHA financing makes it easier for some the homeowners so you’re able to afford a house, however it is not versus its criteria. Definitely evaluate different kinds of mortgage loans to be certain you get the mortgage that is true to meet your needs. But do not be afraid to understand more about the brand new FHA it may be a great way to go into the world of homeownership earlier than you may have expected.