How to proceed with more income: Wise actions you…

More money away from a refund, bonus or other source would be place on the higher-attention personal debt first, eg credit debt.

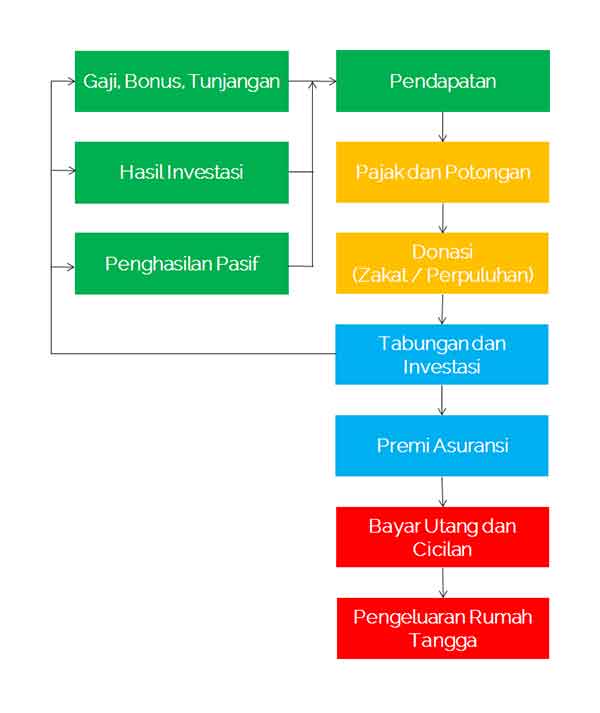

Yes, you could potentially reduce your self, however, a much better method is to place much of your most loans to operate inside the a cost savings or financing membership.

Irrespective of where their most financing might come from – a taxation refund, a heredity, a bonus working if not just a buildup of cash on your own checking account – very first instinct would-be so you can splurge to the a beneficial Michelin-starred meal or discuss the kitchen refurb you have been trying to would for years.

But it pays to pause and think when there is a great financially wiser solution to fool around with you to definitely extra money. Although it will most likely not give you instantaneous satisfaction, playing with an urgent windfall strategically might put you into road so you’re able to rewarding an extended-stored financial goal.

It is preferable to stay having a monetary elite group to determine what might be best for the specific state, but here are a few financially experienced strategies for more dollars you could believe for the time being.

step 1. Pay-off higher-attract debt which have extra money.

May possibly not function as the most enjoyable choice, nevertheless most sensible thing can help you having an excellent windfall are to repay otherwise lose people highest-attention personal debt you might be holding. That is especially important now having higher interest rates, because your bank card, personal bank loan otherwise education loan debt could become so much more high priced if their interest cost are variable, in place of fixed.

After you’ve repaid a card card’s existing balance, lay plans in place to settle people future equilibrium monthly to end accumulating a great deal more high-focus financial obligation.

2. Set more money to your crisis money.

An urgent situation financing is important for everyone who desires an economically stable coming, as you never know after you must security an enthusiastic unexpected household or medical debts.

The general guideline will be to collect 3 to 6 months’ well worth from household expenses. Thought placing it from inside the a premier give offers or money field membership, and that usually earn much more focus than a vintage bank account. That have an emergency finance ensures that there was a supply of bucks in the able, so you won’t need to play with a credit card otherwise tap pension money for those who encounter surprise experiences.

3. Increase your investment efforts which have more money.

Whenever you are already clear of highest-notice obligations and tend to be at ease with your deals, consider using their additional money to enhance your investment membership.

You can begin because of the increasing your efforts towards workplace-paid 401(k) otherwise 403(b), or even one old-age account (IRA). Attempt to lead at the very least ten15% of the pre-taxation paycheck from year to year into later years levels.

If you’ve already maxed out your contributions, imagine beginning or adding funds with other financing accounts, such as a healthcare family savings (HSAs), broker membership or automated paying account.

cuatro. Purchase more cash into the yourself.

In terms of investment, one of the recommended you possibly can make is within on your own. An example is always to rescue for your training otherwise you to definitely away from a relative. A good 529 package are a tax-advantaged financing vehicle you to increases income tax-deferred and you can remains tax-100 % free provided finance are accustomed to pay money for qualified instructional expenditures.

When you have entrepreneurial aspirations, a different way to have fun with more income will be to jump-start their business and turn into your ambitions for the reality. Using more money usually stop any business finance you may want because you initiate and grow your company.

5. Consider the timing when placing more money to your workplace.

When as well as how you find yourself having an earnings excessive normally apply at everything you propose to carry out with the currency.

Such as for instance, for people who discovered a heredity shortly after a family member becomes deceased, it’s probably upcoming at an emotional big date. In this situation, you need to spend your time and perhaps put the currency aside until you getting willing to make conclusion about any of it. Interest-affect profile, plus currency field account or certificates away from deposit (CDs), might online personal loans Hawai be advisable for quick-name saving.

It is possible to determine your budget against people larger expenses that are coming upwards. For individuals who shell out your car insurance rates every six months, including, do you have fun with more cash to track down before those people repayments?

Your own extra cash may also have the form of an effective graduation gift otherwise a holiday added bonus. While you are speaking of meant to be celebratory presents, it’s still best if you believe all your choice prior to a keen effect purchase.

six. Go ahead and reduce on your own that have more funds.

If you are there are a number of economically wise utilizing extra money, additionally, it is okay to invest several of it to the one thing enjoyable. Try to envision they as a result of and make sure your purchase aligns with your complete economic needs and you will specifications.

An intelligent strategy is to get the money on a savings account or take a little while to consider the manner in which you need to purchase they. You could propose to beat oneself having a small section of it, but utilize the people to blow down loans, increase assets or perhaps keep rescuing.

Are innovative that have currency, whether it is an unexpected windfall or perhaps not, is always the most practical way to attain your financial specifications.