What do I need to Be cautious about?

Those who give individual financing to get a profit; A great syndicate band of people which pool money that will be spent on a situation-by-situation base; otherwise, Home loan capital organizations exactly who pond investment regarding investors otherwise individual loan providers for a few loans simultaneously in the event the deals satisfy credit direction.

Are Private Loan providers Controlled?

Personal mortgage lenders commonly controlled, which means you must make sure you might be handling a reputable lender. The way to do this is through first working with the best and really-linked large financial company. A large financial company will also be in a position to show exactly how flexible the lending company try.

Certain lenders is actually stringent and certainly will force a foreclosure otherwise energy-of-deals if you default on the a mortgage percentage. Although some much more flexible and can workout agreements to help you make it easier to keep home for those who standard to the a fees.

Take a look at the contract away from a private financial thoroughly so that you understand the new terminology. You to hazardous name which are slipped with the financial contracts was the latest bona-fide product sales term. This condition helps it be therefore the only way you could break their home loan is through attempting to sell your home.

And additionally, research the reputation of potential loan providers on line. Particular loan providers you ought to stop would-be employed in courtroom instances, fighting individuals for cash.

Just how can Individual Mortgage loans Impact Borrowing?

A personal home loan provides the debtor a way to have shown a self-confident fees record, which the debtor would not be capable demonstrated if not if the ineligible to own a home loan off a financial.

However, as private mortgage lenders dont constantly are accountable to the credit agency, a personal mortgage by yourself will not likely help increase your borrowing from the bank rating. Meanwhile, certain loan providers could possibly get inquire observe lender ideas during the last several days to find out if you have made your personal home loan repayments promptly, which is ideal for your own fees background however, would not effect their credit score.

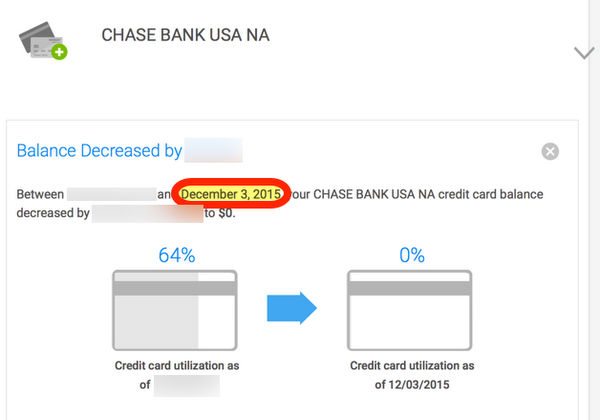

Commonly, a personal financial is used to spend unsecured charge card personal debt which means that if you have no harmony on your borrowing card, they suggests the credit revealing service (Equifax and you can TransUnion) you are good at handling currency along with your credit rating commonly go up. At the same time, if you have poor credit, possibly this new banking institutions need certainly to romantic their handmade cards immediately after they receive money off. Or perhaps your credit rating is really worst that in case you get a private mortgage, you have no productive borrowing.

If this sounds like the scenario, up coming a terrific way to increase borrowing is through getting a good secured bank card. A guaranteed bank card happens when provide a financial institution money, state $2,000, right after which they provide a credit card with this maximum. Once you have tried it for a little while, and therefore long as you have made the necessary costs and you will that the harmony isnt hugging brand new maximum of one’s borrowing card, after that your credit score increases.

Borrowers are advised to possess about one or two productive borrowing from the bank items since this is always a dependence on loan providers to provide the best rates and you may terminology whenever making an application for home financing.

Just how A mortgage broker Helps you

Mortgage brokers makes it possible to weigh the choices when it comes to help you borrowing from the bank home financing. He’s your wade-so you can money for getting a home loan service that is best for you and your financial situation.

Lenders could also be helpful you address and you may rectify people facts which can be stopping you against qualifying to own a traditional home loan. paydayloansalaska.net/teller/ And they will help you produce a strategy-called an escape approach-to move away from a personal home loan to a classic home loan after you are prepared.