How to Assess Your Home loan Demand for Singapore

Just before settling your loan, explore their plan with your tax preparer and you can financing inventor. It’s adviseable to talk about advantages and disadvantages with your monetary coordinator, for those who have one to. Paying the financial early may become best choice for your house. Regardless, the fresh new experienced people in the Ruoff Mortgage is obviously right here to respond to issues which help together with your home financing demands!

Find out the positives and negatives of fabricating full payment of their real estate loan within the Singapore ahead of their plan.

With financial interest rates for the Singapore growing, home owners are starting to help you question if and make full repayments to their mortgage loans before agenda is actually an easy way to store. Because the very first response is sure, this new economic government build and wants away from homeowners helps make the fresh new address faster straightforward.

On occasion, the degree of appeal conserved out of paying home financing early may possibly not be more just what might be received in case your loans is actually dedicated to other asset kinds. There are even many positives and negatives that needs to be analyzed directly before deciding when the paying off a mortgage early is a beneficial of use solution. When you raid the discounts to pay off your own mortgage inside Singapore, you must basic get obvious about precisely how far home loan appeal you are paying whilst underpins your overall home ownership will set you back .

Calculating your own financial focus is an important action because result identifies in the event that to make full percentage on your home loan normally enable you to save on your full mortgage payment. Inside Singapore, financial interest rates are calculated by using the financing amortisation design, labeled as the new cutting equilibrium model, hence advances the main mortgage sum as well as interest across the entire financing period into the several repaired payments.

The brand new month-to-month loan cost number was tabulated according to research by the a good loan amount at the end of monthly, proliferate they of the agreed interest, then separate you to definitely amount from the a dozen. If you have a great S$five-hundred,000 home mortgage to have a residential family into the Singapore and your mortgage rate of interest try cuatro%, your notice commission for 1 few days would-be:

If your exact same mortgage contribution was payable over thirty years (360 days), possible dictate their installment malfunction using a mortgage calculator and also the results will appear similar to this:

New 0.5% improvement immediately caused a growth out of S$ having monthly installment and S$52, to the total count payable. This explains the significance of scouting available for a mortgage when you look at the Singapore that have all the way down cost since the even the littlest differences can amount to large can cost you.

Select the Cheapest Home loans during the Singapore

In the present economy in which high Given costs is actually driving mortgage rates to go up in the Singapore, it creates absolute economic feel to repay as often out-of your home loan you could to quit running into a whole lot more focus. Even if you are unable to https://cashadvancecompass.com/installment-loans-sd/ afford the full commission to the financing, an increase of some hundred cash into monthly installment can be and additionally slow down the total number payable somewhat notably.

Particularly, by paying an additional S$200 30 days against your principal share, your S$500,000 financial which have 4% interest are going to be reduced about initially 360-times period so you can 311 weeks. Which boost in monthly installment may also slow down the overall interest payable by the S$55,. It is extremely a lot of coupons finally!

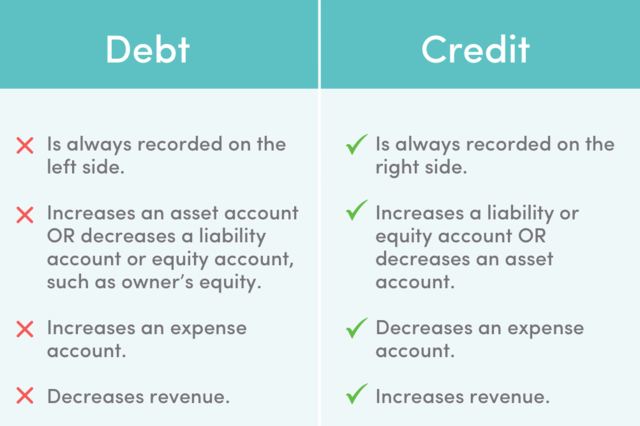

Advantages and disadvantages out of Settling Mortgage Very early

Settling the mortgage is a dream be realized for almost all people. However, prior to going in the future to repay the home loan before the mortgage title was up, there are many advantages and disadvantages that you need to capture into consideration.