How can i Be eligible for a bank Report…

As part of the application processes, the lending company commonly show your earnings and you will expenditures from the requesting an excellent confirmation away from deposit out of your bank. The lending company constantly reacts from the mail otherwise fax. Second, the program experiences the latest underwriting techniques. According to complexity of your own monetary files, underwriting usually takes 21 forty-five days to do.

- Definitely has sufficient documentation to prove that you’ve come self-useful about 2 yrs, and you will you kepted about 20% to have an advance payment. Lenders who bring lender statement loans normally like to see one to you have managed to help save dos half a year of money supplies.

- Possess bucks supplies available to you. Make certain that you have secured sufficient currency to cover a few days out of home loan repayments and perform any brief-identity needs otherwise problems. Can you imagine, such as for example, you set aside $ten,one hundred thousand of your own $20,100 during the discounts for the home loan repayments (dominant, attract, taxes and you will insurance rates). You might possess 5 months’ property value mortgage payments spared.

- Try to avoid warning flag, eg bounced monitors, nonsufficient money charge and unexplained bucks deposits. Dipping towards savings much or constantly becoming overdrawn brings out alarm bells to own lenders and advances the odds of your loan application getting denied.

- Always be upfront regarding the purchasing habits and become willing to explain questions a loan provider otherwise underwriter have regarding the earnings.

The fresh new requirements so you can get a financial statement financial due to the fact a self-functioning borrower varies by the lender. However, check out standard requirements you’re going to have to see to help you safer a lender declaration home mortgage:

- several a couple of years out of bank statements exhibiting dumps and you may withdrawals for money disperse proof (You can buy on the internet statement duplicates from the on line banking account.)

- Evidence of no less than couple of years off worry about-a job or bargain really works

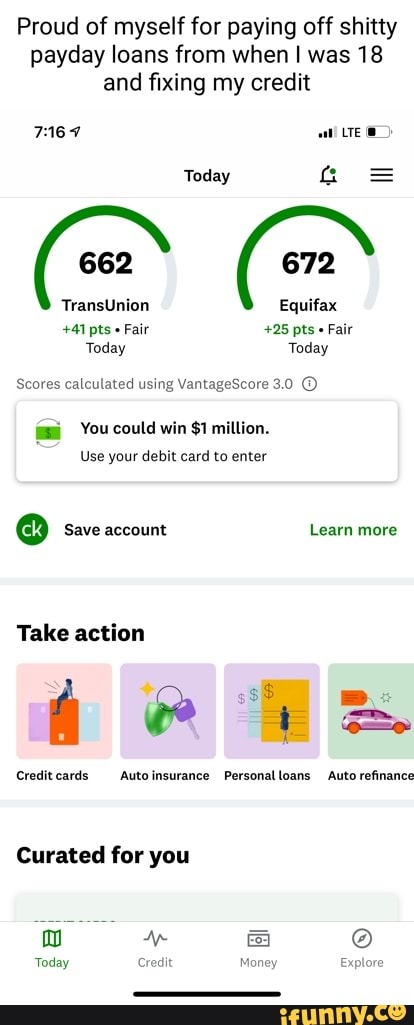

- 660 credit score or higher

- 20% deposit otherwise 10% off that have home loan insurance policies

- A DTI as much as 50% (you will need to lower normally of your loans as you can also be before you apply)

Despite good credit and you can a massive down payment, it can be challenging for a debtor so you can safer a competitive financial statement financing rate of interest. In fact, excellent credit and lower-to-zero debt commonly an ensure that the application form techniques could be hanging around.

Just after a lender assesses the lender interest and you may identifies your debt-to-money (DTI) proportion (the percentage of their terrible month-to-month money applied into the the debt), they will certainly decide how far your meet the requirements to help you acquire

A loan provider can get demand even more records ahead of providing a bank report loan, like a letter out of your accountant or bookkeeper detailing the providers costs and guaranteeing your revenue due to the fact another builder or freelancer.

Pro suggestion: Improve odds of getting a financial statement financial (plus one with a decent financial report mortgage rates) by keeping your bank account in order.

You will need to pay one obligations versus experiencing the money you have reserved for the down-payment otherwise dipping to your bucks supplies. Be mindful of your finances balance to prevent overdrafts. Try not to get any large-money financing six 8 months before you apply into mortgage. Incase the bank or underwriter requests for an explanation or way more files ahead of they are going to promote a bank declaration loan, perform Today and stay truthful and you may upfront on your telecommunications.

How do i Get a hold of a bank Declaration Financing?

Its not all mortgage lender also provides financial report funds. Required some extra try to pick a lender who’ll qualify you centered on lender statements in the place of taxation files.