?? Jeopardizing your credit rating for the to invest…

“Your mortgage top-notch will guarantee that you buy the house or apartment with financing merchandise that has the best interest rates and words therefore, the payment is comfortable,” Peters saysmitting to better monthly installments outside the family’s budget are where many some body generate a major mistake.

Your credit rating is an important monetary element of the house to purchase procedure constantly. A loan provider is going to run a credit history to aid dictate the fresh new home loan amount you are pre-accepted getting, nonetheless it cannot loans Coffee Springs stop indeed there. Before you romantic to your domestic, your credit history would be taken again to be sure things are managed in addition to marketing can be proceed just like the arranged. Thus, keeping good credit was most important. Together with, it’s best to avoid beginning otherwise closing bank account, obtaining the brand new handmade cards and you may to make any high instructions during the this period.

?? Disregarding the regional

When you possess discover our house, support the entire people in mind using your research. You might upgrade and revise a house, however you cannot change the society or area. Look at the brand of community you enjoy, the fresh new home’s place and its particular proximity into the performs, schools and you may facilities. You should also envision in terms of resale really worth whenever viewing properties.

?? Not working with a good real estate attorneys

Certain claims want a bona-fide property attorney to do the transaction, in which particular case it pays to-do your own research and you will opt for the right one. Keep in mind that it is an added cost. “Your own real estate attorney’s character is important, because they discuss the primary regards to the deal and put clauses that will include you for the pick procedure,” Peters shows you. This can be one more reason as to the reasons dealing with a knowledgeable real estate broker is very important, as they can strongly recommend a trusted home attorneys to join your own group.

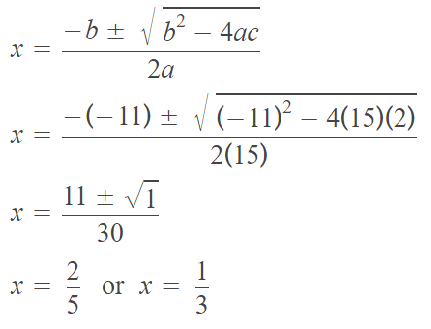

?? Failing woefully to research financing systems

Some body have a tendency to believe good 20% down-payment with the property is the practical. Although not, that’s not necessarily the case, particularly if you try a primary-big date homebuyer. You will find FHA fund, that allow you to definitely lay out as little as 3.5% for folks who satisfy certain financial criteria. There are also Virtual assistant funds that do not want a down payment having veterans, and you can USDA finance from the Agencies out-of Agriculture that do not label to have an advance payment to your attributes within certain areas. You could make the most of some earliest-go out homebuyer apps, whether they are government, condition otherwise workplace-depending.

?? Are unaware concerning the initial can cost you

Get informed regarding upfront will cost you employed in buying your very first home. The last thing you prefer was shocks along the way. Pose a question to your realtor to have a summary of will set you back in order to expect for the processes as well as when you purchase the household. As well as the advance payment, there are more will cost you such as for example property check otherwise an effective a home attorney’s commission.

?? Trying out your own discounts

Buying your basic residence is more than likely the greatest pick you may have ever made, however, using up all your discounts to close the offer is maybe not smart. Unforeseen expenses occur even long after you intimate on assets. If you find yourself transitioning away from a small studio flat, decorating your family may be high priced. Otherwise, if you’ve never ever had a patio and have now you to, maintenance and you will the new products will demand most commands. Simultaneously, this is together with in which property inspection is available in – it gives you a concept of the price to restore or ree getting when men and women expenditures will be called for.